Dumelang*. As I have been reading the local press, internet articles and other literature, I was surprised at the number of coal-based projects that have been proposed for Botswana over the years. I was having trouble keeping them all straight so I decided to collect, summarize, and tabulate these coal projects. At the same time, I wanted to take a hard look at coal as an energy resource.

It is generally believed that Botswana has significant coal resources and it is clear, based on the existing, planned, and proposed projects listed in the table in the Coal Projects in Botswana tab on this blog, that coal will continue to be an important resource for Botswana well into the future. These projects range from the new coal-fired generators at Morupule, the refurbishment of the Morupule A operation, new coal-fired operations, coal-bed methane, coal-to-liquid projects, and new mining operations.

A number of years ago there was a flurry of project proposals to start up new coal mines and to build new power plants on-site or close to these collieries to feed electricity into the Southern African Power Pool. However, since the construction and partial commissioning of the large Kusile (4800 MW) and Medupi (4800 MW) coal-fired projects in South Africa, in combination with load shedding, efficiency drives, and renewable energy projects, there appears to be less call for smaller independent coal-fired power plants. Few, if any, of these smaller projects have gained traction.

The list of coal projects proposed for Botswana is long. (See the Coal Projects in Botswana tab on this blog.) Most of the projects are at varying stages of preliminary assessment—some are still under review, some have completed detailed feasibility studies, and some are just proposals—but most are currently on hold because of the large capital investments required and low coal prices. Moreover, many of the projects have been suspended because they are export-market driven and require the establishment of railroad infrastructure to Namibia or Mozambique to deliver coal to the international markets.

Coal is a troublesome energy resource. It is cheap and readily available. One tonne of coal, which costs about $50 on the world market, contains 24 000 MJ of energy—or approximately four times that of a $50 barrel of oil. Despite its high energy content, coal needs to be converted into another energy form to be useful: this could be as electricity or, in the case of the Sasol operations in South Africa, into liquid hydrocarbon fuels.

The ready availability and high energy content of coal is offset by the high levels of pollution associated with its use. Coal consists largely of carbon, as well as varying amounts of hydrogen, oxygen, nitrogen, and sulfur. Coal used for electricity generation normally has a carbon content greater than 75% and also contains compounds of aluminum, calcium, and silicon that form ash when the coal is combusted. Coal is also contaminated with deleterious metals, such as cadmium, mercury, selenium, lead, and others. The key problem associated with coal is that, on burning, it releases these nasty elements, as well as fine particulate matter, sulfur dioxide, nitrogen oxides, and carbon dioxide: these all end up in the off-gases and are released into the environment. Some coal plants incorporate expensive particulate-capture and gas-scrubbing units to reduce the emissions, but considerable quantities of these pollutants are still released into the atmosphere. In terms of greenhouse gases and increasing levels of carbon dioxide in the atmosphere, coal is particularly bad and coal-fired electricity is the largest contributor to man-made carbon dioxide emissions.

Coal or fly ash is another problematic byproduct of coal combustion. This consists largely of a fine, non-combustible silica and calcium oxide residue and can contain appreciable amounts of deleterious elements like cadmium, chromium, and others. The ash is stored on-site at power plants or is disposed of in landfills. In some cases, it can be used as a component of Portland cement.

It is all these nasty byproducts (deleterious metals, coal ash, carbon dioxide, fine particulates, and sulfur dioxide) that are behind the widely accepted assertion that coal is a dirty fuel…And this does not even begin to consider the issues associated with coal mining—which is a dangerous, difficult, and complex operation that has significant environmental impacts. Mined coal cannot just be used as is: it needs to be treated through various mineral-processing operations to upgrade its quality and reduce the portion of non-coal components. This beneficiation requires water and also produces a significant quantity of byproducts – known as middlings and discards. These byproducts can represent up to 50% of the mined ore and are typically accumulated on site at the colliery and stored indefinitely. Moreover, the sulfur in this mining waste reacts with air and water to form sulfuric acid which leads to acidic runoff, known as acid mine drainage, which, if not controlled, can contaminate local water supplies.

In a future post, I will take a look at “clean coal” and the many options available to mitigate the harmful effects of coal combustion. Each of these approaches has pros and cons, but in every case there is a significant economic penalty to be paid. As a result, promoting coal projects with state-of-the-art clean coal and pollution control installations requires enormous political will, stringent regulations, and the willingness to take on increased capital and operating costs—which will ultimately result in higher electricity costs. This is a price that many less developed countries are simply not in a position to pay.

When I cover coal as an energy source with my MBA students in the Energy and Sustainability track at Franklin Pierce University, I have them consider the entire value and utilization chain associated with coal, along with its inputs and outputs, so that they can appreciate the complexity and implications of the coal-fired electricity business. A summary of this value chain is reproduced below. As can be seen, the coal-fired electricity business is complicated, with several energy, water, and labor inputs and numerous outputs that have significant impacts on the environment. All of these energy and water inputs and the polluting and harmful outputs need to weighed against the benefits of useful electricity generation—without which our modern lives would not be possible.

Despite these drawbacks, coal will continue to be a very important fuel for a very long time all around the world. Some countries are moving away from coal and closing down aging coal plants, but these countries possess alternative sources of energy, such as those of natural gas and nuclear reactors, and, in some cases, renewable energy from solar and wind. These alternatives are not options for less developed countries like India, China, and much of Africa at present: coal will continue to be a very important part of the energy supply in these countries, regardless of the long-term environmental impacts. Ideally, one would like all coal-related projects to carefully evaluate the long-term environmental impacts of coal mining and coal burning against the immediate benefits of electricity production, but, unfortunately, this is (for various reasons) not always done.

Exploiting the coal resources in Botswana is a challenging endeavor. Mining is straightforward, but, once mined, the coal becomes a stranded resource. It is difficult to export due to the lack of direct rail links to the port of Walvis Bay in Namibia or to Mozambique via Zimbabwe, and there is limited rail traffic to Richards Bay in South Africa. Moreover, exporters of Botswana coal have to compete against large established coal mines in South Africa that have better access to transportation and export networks. There have been several proposals to build rail links to Namibia or Mozambique, but, owing to the cost of these rail links and low prices for coal, there has been little progress of these beyond the discussion stage.

The world is presently awash in coal: demand in countries such as the US and China is down; there is an excess of supply from coal-exporting countries like the United States, Australia, and Indonesia; so coal prices are depressed. The figure below shows spikes in coal prices in 2008 and 2011, which drove a lot of the interest in coal mining and coal-based projects. Since then, however, prices have fallen off considerably and are currently the lowest they have been in the last 10 years.

|

| Source: InfoMine** |

The exploitation of coal resources in Botswana is further complicated by the present water crisis in the country. As shown in the value chain above, coal mining and electricity generation require a great deal of water: any coal-related projects need to ensure a steady supply of water in the face of challenging shortages in the country.

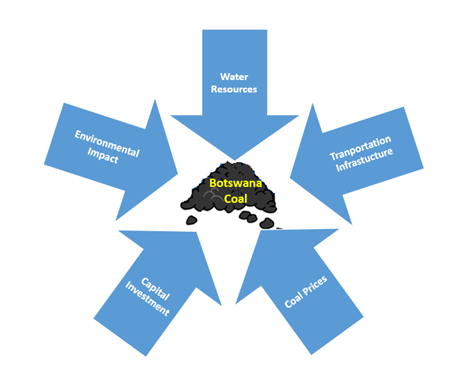

Overall, coal exploitation in Botswana can be viewed as being under pressure from five directions, as shown in the figure below: 1) capital investment, 2) coal prices, 3) water resources, 4) environmental impact and increasingly stringent legislation, and 5) lack of transport infrastructure. Pressure can be relieved, to a degree, by exploiting these resources internally, such as by building more in-country power plants and perhaps even coal-to-liquid operations. Even so, such projects need large capital investments, large water requirements, and will still have significant environmental impacts. The successful exploitation of coal in Botswana will require dealing with all of these factors.

In my next blog, I will take a closer look at coal projects that do not involve the generation of electricity, particularly those involving coal-bed methane and coal-to-liquid production. Until next time, remember to turn the lights out when you leave the room so that less coal has to be burnt.

Tsamayang Sentle***

Mike Mooiman

mooimanm@franklinpierce.edu

(*Greetings in Setswana)

(**Coal pricing is complicated: it depends on source and destination locations, quality, ransportation, and a host of other factors, so I have just used the North American Central Appalachian price (CAPP) as a proxy for international coal prices.)

(***Go well or Goodbye in Setswana)

No comments:

Post a Comment

Please feel free to comment but note that I have added a verification step to avoid the large amount of spam that can make its way into the comment area. An annoying but necessary step these days.